Cost of Living in London – A 2025 Guide

London is an exciting but expensive city to call home. From soaring rent prices to high transportation and utility costs, living in the UK capital demands smart budgeting. This guide breaks down the major expenses you can expect in London, compares them with cities like Dubai and Manchester, and offers practical tips for managing your finances.

1. Housing Costs in London (Rent)

Housing is typically the largest expense for London residents. With the median rent around £1,500 per month and 1-bedroom apartments in the city centre averaging over £2,100 per month, it is no wonder that many opt for shared accommodations to cut costs.

- 1-bedroom in city centre: ~£2,100–£2,200/month

- 1-bedroom outside centre: ~£1,600/month

- 3-bedroom in city centre: Over £4,400/month

To save money, consider flat-sharing or living in outer boroughs where rents can be considerably lower. Even if you are on a modest income, sharing your living space might be the key to affording the London lifestyle.

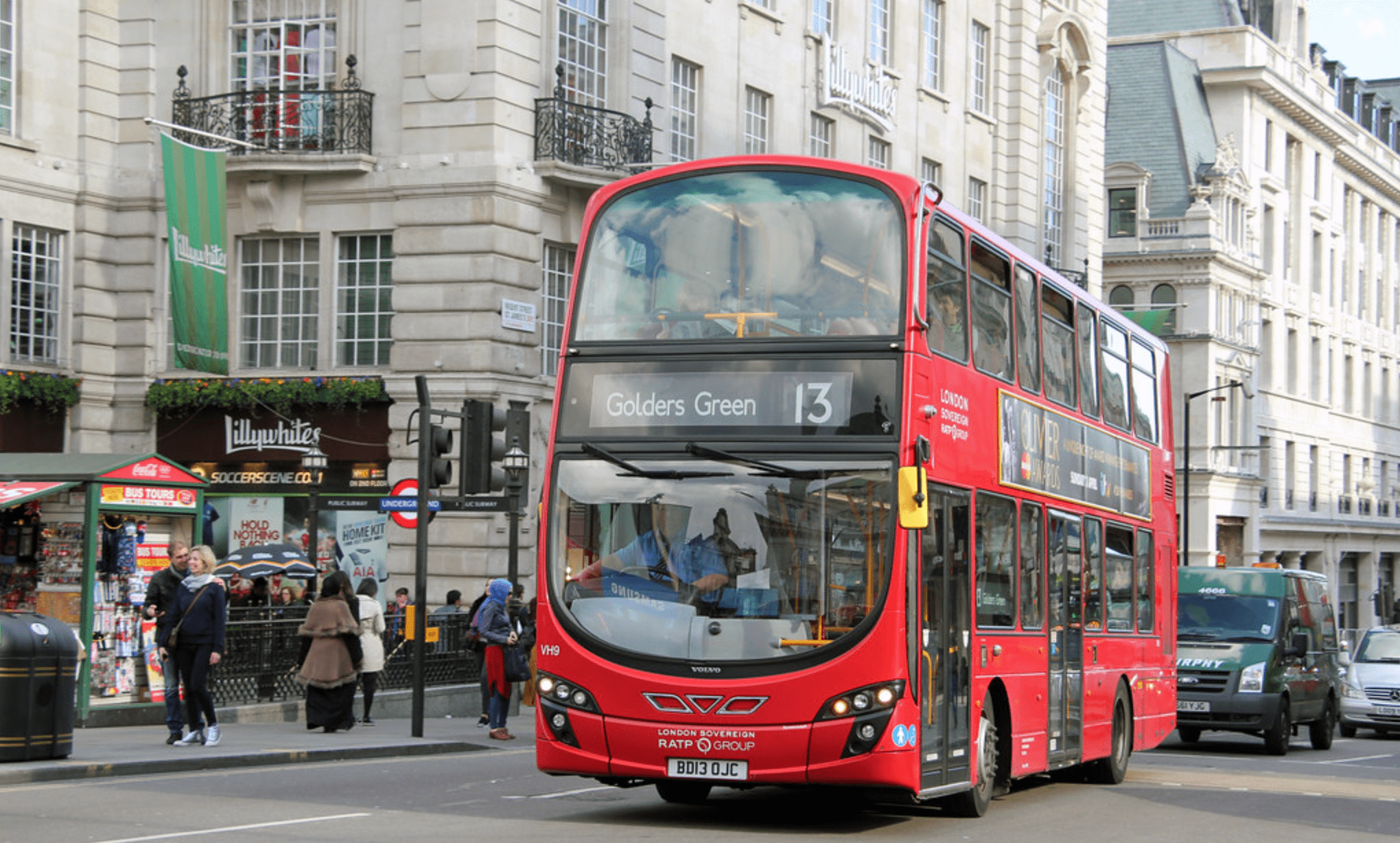

2. Transportation Costs

London boasts one of the best public transportation systems in the world, but it comes at a price. A monthly travel card for Zones 1-2 can cost around £150-£160, while owning a car could lead to additional expenses like congestion charges and expensive parking fees.

- Monthly public transport pass (Zones 1-2): ~£150-£160

- Single bus fare: ~£1.75

- Zone 1 Tube fare: ~£2.50-£3

- Congestion charge (if driving): £15/day

For most residents, using the Tube, buses, or cycling is the most cost-effective way to navigate London.

3. Food and Grocery Expenses

The cost of groceries in London is comparable to the rest of the UK, though inflation has pushed prices higher recently. On average, a single person may spend between £200 and £300 per month on groceries.

- Milk (1 liter): ~£1.30

- Bread (500g loaf): ~£1.20–£1.50

- Eggs (dozen): ~£3.00–£3.50

- Chicken breast (1kg): ~£7–£8

Dining out is a different story – a meal at an inexpensive restaurant can cost around £15–£20 per person, and even a coffee can set you back £3–£4.

4. Utility Bills

Utility bills, including electricity, gas, water, and broadband, can add up quickly. For a standard apartment, expect to pay around £340–£350 per month in total for utilities.

- Basic utilities (electricity, heating, water): ~£315/month

- Internet: ~£30–£35/month

In addition to these, council tax – which varies depending on the borough and property band – can further increase your monthly expenses.

5. Entertainment and Leisure Costs

London offers world-class entertainment and leisure, from West End shows to museums and fine dining. However, these experiences often come at a premium. For instance, a dinner for two at a mid-range restaurant might set you back around £70–£80, while a movie ticket can cost up to £16.

- Restaurant meal (inexpensive): ~£15–£20 per person

- West End show tickets: ~£40–£60 per person

- Cinema ticket: ~£14–£16

- Gym membership: ~£50–£70/month

Take advantage of the many free museums and parks to balance out these costs, and look for discounts or off-peak rates whenever possible.

6. London vs. Other Cities

How does London compare to other cities? Here is a quick look at the cost differences between London, Dubai, and Manchester:

| Expense | London | Dubai | Manchester |

|---|---|---|---|

| Rent (1-bed, city centre) | ~£2,175/month | ~£1,825/month | ~£1,170/month |

| Monthly Transport Pass | ~£160 | ~£65 | ~£83 |

| Meal at an Inexpensive Restaurant | ~£20 | ~£9 | ~£15 |

As you can see, London is significantly more expensive than Manchester in almost every category, and even compared to Dubai, the premium is clear – especially in housing and transportation.

7. Tips for Managing Expenses in London

Living in London on a budget is challenging but possible. Here are some practical tips:

- Budget Wisely: Track your expenses using budgeting apps to stay on top of your spending.

- Consider Flatsharing: Share your living space to reduce rent and utility costs.

- Use Public Transport: Invest in a monthly travel card and consider cycling to save on daily fares.

- Shop Smart: Take advantage of discount supermarkets and local markets to reduce grocery bills.

- Enjoy Free Activities: Explore London free museums, parks, and cultural events.

Conclusion

While the cost of living in London can be daunting, planning and budgeting can make the city expenses manageable. Whether you are a student, a professional, or a family, understanding these costs will help you enjoy London without breaking the bank.

Embrace the adventure of London living – with smart choices, the vibrant lifestyle of the UK capital is well within reach.